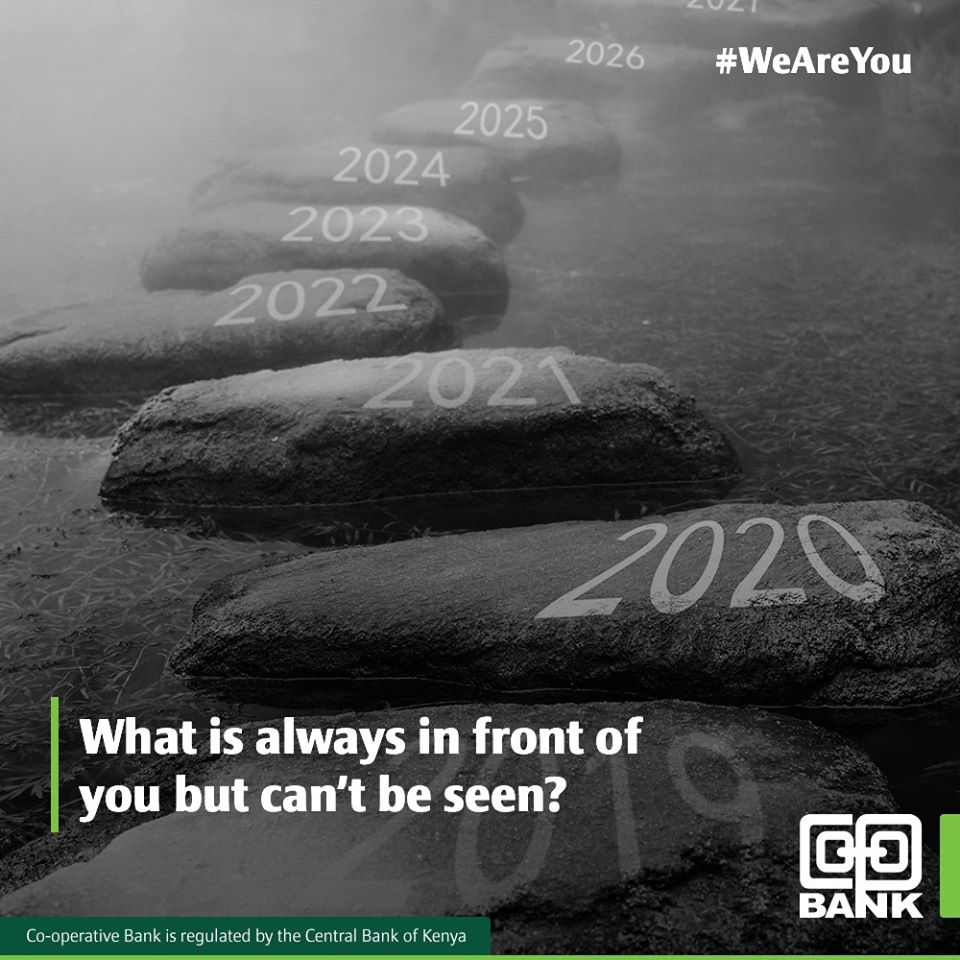

Are you in the trucking business? The journey is not that easy. You cannot predict what lies ahead of you.

Despite your business doing quite well, there will always be ups and downs. Successful business people use these moments to improve and elevate their business to greater heights.

Technology is one big platform that allows entrepreneurs to provide services to their customers and workers seamlessly.

Njiru Mugane, of Njiru & Sons Ltd, is a Mwea businessman. He’s made progressive effort to stay top of the digital financial trends – as a longtime Co-op Bank client.

He uses MCo-op Cash App on the move, through his phone. It has helped him seamlessly integrate his business with his family life.

How has Co-op Internet Banking bridged the business-family life gap?

Njiru has invested heavily multiple gas stations across the country, and in the haulage industry – with a fleet of trucks.

According to Njiru, effectively managing all the trucks at is a logistic nightmare. Drivers would call him at all hours – in the wee hours, strokes past midnight – complaining of truck breakdowns, law brushes at toll bridges, amongst other challenges.

He always had trouble wiring money to drivers and mechanics to cater to repair costs, but with MCo-op Cash, it’s been easier.

Now, he can make instant cash transfers, instant withdrawals or send money for far off garages for minor repairs or spare purchases.

For transparency, he usually makes direct cash transfers from his Co-op Bank account directly to the accounts of the servie providers. Sometimes, even to other banks.

It gives meaning to ‘Send money KI-Pro’! He says the process is fast and effective – he doesn’t even have to wake up from his bed!

Still, Njiru to keep growing, he recognizes the efforts put in by all his workers – and aims to retain his staff for long relationships.

Most of his competitor companies delay salaries. At times, the employer is at fault, sometimes banks are slow to disburse the money due to slow systems.

Njiru’s employees hardly ever suffer that fault.

Njiru’s operational secret is his reliance on Co-op internet banking system. He easily wires money directly to his employee’s accounts – wherever they are.

Money reflects instantly, unlike the outdated systems that took days. Plus, it’s a huge help on the book keeping.

How do you register for Co-op Internet Banking (MCo-op Cash)?

– Visit the nearest Co-op Bank branch and talk to an agent.

– You need your national ID number and account number to link your account to your mobile number.

– A one-time activation pin (OTP) code will be sent via SMS.

– Go to Playstore (Android phones) and download the MCo-op Cash App. It’s free.

– To activate the app, use the OTP sent by the bank. The bank agents will assist.

– Once you access your account, change the passwords to your secret numbers.

– For a phone not internet enabled, activate your MCo-op cash by dialling Co-op Bank USSD*667#.

If you decide to use the USSD code, you should at least have some airtime balance.

To learn more about Co-op internet banking, follow this link here, or talk to an agent at your nearest branch.